M News: What's New With Us. What Matters To You.

New changes to our bank URL

December 29, 2020 3:32 pmIn order to provide you with even greater online security, “merchantsbankal.com” is now “merchantsbankal.bank”. Only our URL has changed, but with this simple change comes additional security features designed to keep your personal and financial information safe.

With our transition to merchantsbankal.bank now complete, you can be assured that when they visit our website, or communicate with us electronically, enhanced security and verification requirements are in place in order to reduce the risk of cyber threats and enable us to continue to build on our highly-trusted secure environment.

I don’t see many other banks moving to .BANK, why did Merchants Bank of Alabama, a division of SouthPoint Bank?

We believe our customers deserve the best online security! We take the security of our customers’ information very seriously and therefore chose to take this extra step to give Merchants Bank of Alabama customers peace of mind when banking with us online. We believe that the .BANK domain provides an additional layer of security that the other top level domains such as .com do not.

Why is .BANK more secure?

.BANK domains signify that a company has been verified as legitimate and is committed to implementing the additional and mandatory security requirements that go beyond existing standards. Only verified banks are allowed to use the .BANK domain. Therefore, when you see a domain which ends in .BANK, you can be assured that you are dealing with a legitimate, verified financial institution.

Because of the additional security measures taken in the verification process, cybercriminals can be identified and denied the right to obtain a .Bank domain name. Therefore, the .Bank environment provides an enhanced level of security against imposter sites and peace of mind for our customers and business partners.

What are the enhanced security requirements in .BANK?

Mandatory verification of charter/licensure for regulated entities ensures the organization requesting the domain is legitimate, the person requesting the domain name is authorized by the company and that the name requested by the company complies with all policies.

- Domain Name System Security Extensions (DNSSEC) to ensure that Internet users are landing on participants’ actual websites and not being misdirected to malicious ones;

- Email authentication to mitigate spoofing, phishing and other malicious activities propagated through emails to unsuspecting users;

- Multi-factor authentication to ensure that any change to registration data is made only by authorized users of the registered entity;

- Strong encryption to ensure security of communication over the Internet;

- Prohibition of Proxy/Privacy Registration Services to ensure full disclosure of domain registration information so bad actors cannot hide.

Please Note: Our old “merchantsbankal.com” URL will continue to redirect to “merchantsbank.bank”, but be sure to update your bookmarks accordingly. Feel free to contact us if you have any questions or concerns about our transition to “merchantsbankal.bank”.

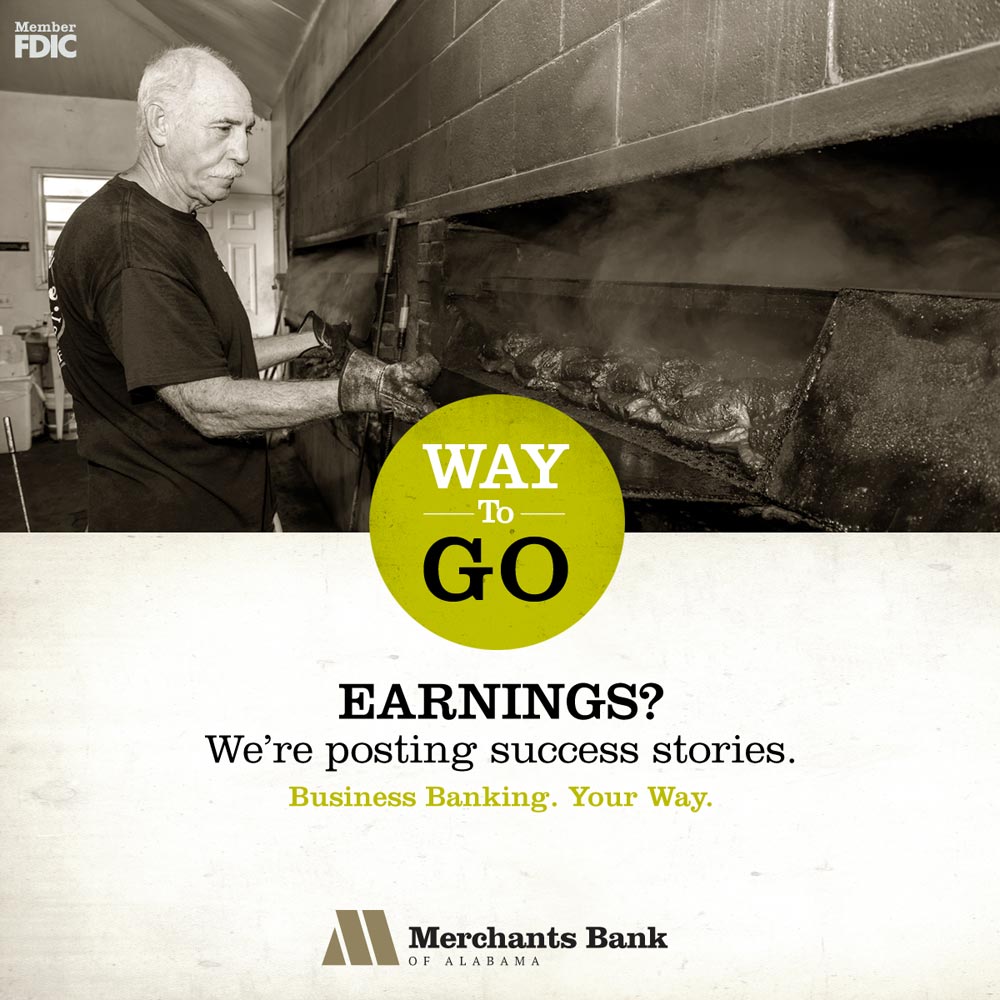

Finding A Way To Go Your Own Way With The Right Small Business Loan

August 24, 2017 8:34 pmEveryone loves your homemade BBQ sauce, and you’ve started to wonder if you could actually create a business out of it. You learn about your potential market, create a business plan, develop your brand, work out the costs, find a location, and then what? More than likely you’re going to need a small business loan.

There’s no better place than to look to your local community bank. Community banks like Merchants Bank of Alabama, a division of SouthPoint Bank, tend to focus on the needs of the businesses and families where the bank holds branches and offices. They are also typically locally owned and operated meaning they know you, your family and how your business idea will fit into the local economy. And, perhaps the main benefit is that lending decisions are made by people who understand the local needs of families, businesses and farmers.

Two years ago, when we launched our new website, we set out to develop tools that would help our local small business customers. How are we different? What sets us apart? We knew that our local lenders connected us to our communities in very powerful ways that big banks can’t touch. That’s why we created a section on our site called Lender Connect. Here you can meet our local lenders and easily connect with them via phone or email. You can also get to know these local lenders by reading their bios. You’ll quickly see that the majority of them not only live here, but were born and raised here.

Merchants has developed real partnerships with local businesses and you can read about some of our local business success stories in the Way To Go section of our web site. Eight very different local small businesses with one thing in common. A bank with an uncommon commitment to our local small business customers. Read the stories and you’ll get the inside scoop on how we helped these remarkable business owners in Cullman, Hanceville, Fairview and Arab go from having a big dream to having a big following. Because community banks are themselves small businesses, they understand the needs of small business owners. Their core concern is lending to small businesses and farms and they make over half of all small business loans.

Get to know the local businesses near you. No matter what their product or service, their focus is delivering the best in customer service, just like their local bank does. From local restaurants and volunteer fire departments to a variety of retail establishments, we set out to build real relationships with our business customers.

Small business loans are available from a large number of traditional and alternative lenders. Small business loans can help your business grow, expand into new territories, enhance sales and marketing efforts, allow you to hire new people, and much more.

So, if you need to secure your first small business loan or to expand a current business, we invite you to start with your local community bank. Reach out to the lender nearest you, preferably via our Lender Connect portal. To give you even more information, we are sharing an article from a recent issue of Forbes, “10 Key Steps To Getting A Small Business Loan”. By anticipating what lenders will review and require, you will greatly increase your chances of obtaining a beneficial small business loan.

Read the full article at forbes.com.

Behind Every Successful Small Business You’ll Find A Local Bank

June 20, 2017 1:14 pmWe’re a small business friendly bank and have been since 1907. Community banks make over half of small business loans employing 2 out of 3 people. Because community banks are themselves small businesses and are local, they understand the needs of small business owners especially when it comes to small business lending and way better business banking. Their core concern is lending to small businesses and farms. The core concern of the mega banks is corporate America. We have added three small business success stories featuring our small business customers: Top Hat Barbecue, Van’s Sporting Goods and Werner’s Trading Company. Read about why Merchants Bank of Alabama, a division of SouthPoint Bank, is their small business bank of choice.

FACEBOOK

FACEBOOK